Latest Update 2021: Under Sukanya Samrudhi Yojana 2021 (સુકન્યા સમૃદ્ધિ યોજના ની માહિતી), you can deposit Amounts ranging from Rs 500 to Rs 1.5 lakh. We Provide All Details Like Inreste Rate, Term & Condition, How to Open SSY Account in bank, and How to Bank calculate interest on Sukanya Samridhi Yojana account. The plan is for daughters. Opening an account in this scheme will give you relief in future expenses including your daughter’s education.

How to open Sukanya Samridhi Yojana account?

Under Sukanya Samridhi Yojana, the account can be opened at an authorized branch of a post office, Any Bank or commercial branch.

Rules for opening Sukanya Samridhi Yojana Account Sukanya Samridhi Yojana account can be opened by the child’s parent or legal guardian in the name of Girl Child before the age of 10 years. According to this rule only one account can be opened for a child and money can be deposited in it. Two accounts cannot be opened for one child.

How will the amount be deposited in Sukanya Samridhi Yojana account?

The amount can be deposited in Sukanya Samridhi Yojana account by cash, check, demand draft or any such instrument which is accepted by the bank. For this it is necessary to write the name of the depositor and the name of the account holder. The amount in Sukanya Samridhi Yojana account can also be made through electronic transfer mode, if the core banking system is present in that post office or bank. If the amount is paid by check or draft in Sukanya Samridhi Yojana account, interest will be paid on it from the time the amount is cleared in the account, whereas in case of e-transfer it will be calculated from the day of deposit.

Sukanya Samrudhi Yojana Main point

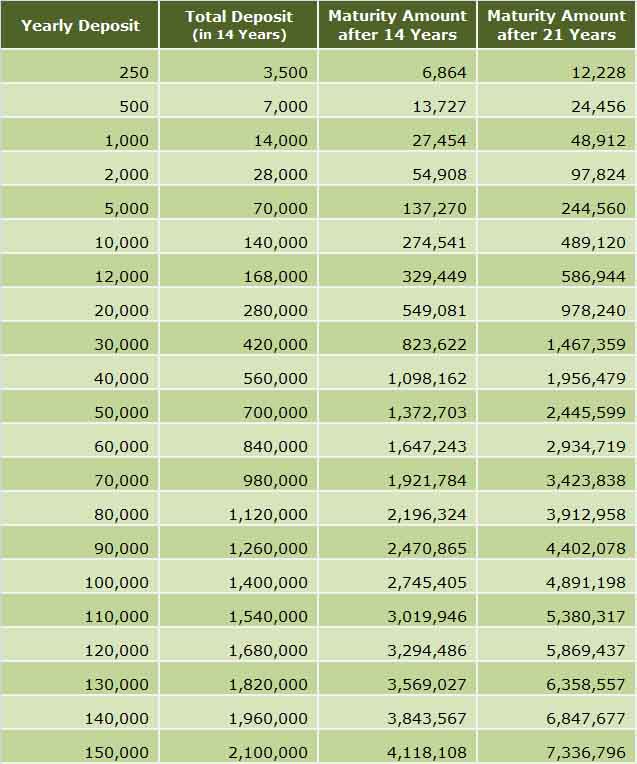

➖ You can deposit 1 thousand to 1 lakh fifty thousand rupees in a year in the name of daughter in Sukanya Samrudhi Yojana account.

➖ This money has to be deposited only for 14 years of opening the account and this account will mature only when the daughter turns 21 years old.

➖ Under the rules of the scheme, a daughter can withdraw half a penny when she turns 18.

➖ After 21 years the account will be closed and the money will go to the guardian.

➖ If the daughter gets married between the ages of 18 and 21, the account will be closed at that time.

➖ If the payment is late in the account, only a penalty of Rs. 50 will be imposed.

➖ Apart from post offices, many government and private banks are also opening accounts under this scheme.

➖ Accounts under Sukanya Samrudhi Yojana will be exempted under Section 80-G of the Income Tax Act.

➖ The guardian can also open two accounts for his two daughters.

➖ If there are twins, the guardian can open a third account only by giving proof. The guardian will be able to transfer the account anywhere.

Sukanya Samrudhi Yojana Below documents will be required to open a new account

➾ Account opening form in Sukanya Samrudhi Yojana

➾ Child’s birth certificate

➾ Depositor’s Identity Card such as PAN Card, Ration Card, Driving License, Light Bill, Phone Bill etc.

➾ Net banking can be used to deposit rupee

➾ Passbook will be given at the time of account opening

:: Important Link ::

Download Sukanya Samrudhi Yojana form (સુકન્યા સમૃદ્ધિ યોજનાનુ ફોર્મ)

How is interest calculated on Sukanya Samridhi Yojana account?

નીચે બોક્સ માં 1 વર્ષ માં તમે જેટલા રૂપિયા ભરી શકો તે નાખવાથી 21 વર્ષ બાદ તમને મળવા પાત્ર રકમ દેખાશે

How long can this account be maintained?

After opening an account of Sukanya Samrudhi Yojana, the account can be maintained till the age of 21 years or marriage after the age of 18 years. If at least Rs. If the 250 deposit is not deposited, the account will be closed. For that year with a minimum deposit amount of Rs. Can be resumed with a fine of Rs.

How much penalty can be taken in Sukanya Samrudhi Yojana?

If you spend at least Rs. If 250 is not credited, the account will be closed. The minimum amount required for a deposit that year can be revised with a penalty of Rs 50 per annum penalty. This account can be resumed up to 15 years after opening.

Contact Email : contactgujjuonline@gmail.com

Notice :

અમારા લેખનું લખાણ કોપી કરતા પહેલા અમારી લેખિત મંજુરી લેવી જરૂરી છે.

Hello Readers, GujjuOnline.in is a private website and don’t represent any government entity, organizations or department. Whatever information we shared here is gathered from various Gujarat government’s official website and news papers and other websites. We also cross verify the job when we post any job but do always cross verify the job vacancy by yourself to prevent fraudulent happening in the name of job.